Online Business: Three Guide Lines On Collecting Online Sales Tax

|

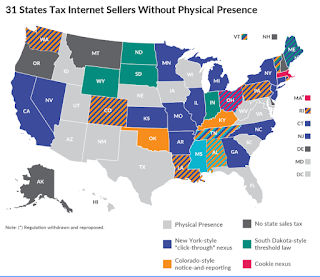

| Courtesy Of TaxFoundation.org |

Internet retailers can be required to collect sales taxes in states where they have no physical presence, the Supreme Court ruled on today; June 21, 2018.

The Court upheld a law passed by South Dakota lawmakers in 2016 that requires out-of-state online sellers to collect the state’s sales taxes if the companies have more than $100,000 in annual sales of products to South Dakota residents or more than 200 separate transactions involving state.

There are currently 31 states who have laws taxing Internet sales as shown in the map below.

|

| Courtesy Of TaxFoundation.org |

These are three easy steps to understand how the Internet sales tax will apply to your business.

1. What is your sales volume?

The threshold is 100,000 USD in sales OR 200 transactions - both within one year.

2. Identify the state of transaction.

Let's say you sell in five different states. You need to start measuring the transaction count and sales volume for each state you do sales in.

3. Contact State office to get specific information

It's a good time to get the "official" information for states that you do online business in. That official source of information is going to start with the Secretary of Sate for each State.

Link to Secretary Of State in all USA States is here.

If you need additional sales tax info in a state, which means drilling down to the county level, you will likely have to contact the Treasurer of each county.

Comments

Post a Comment